Zero Basis Points

⚔️A War for the Soul of Advice

A war is coming…

A battle, an invasion, a complete re-mapping of the industry…

You’ll see.

But first, a shoutout. The inspiration for today’s subject line is from the Zero Basis Points podcast by Haik Sahakyan and George Guidotti of ARQA:

They’ve built a great podcast! And to be honest, I’m not exactly sure what “Zero Basis Points” means… other than that their podcast is free.

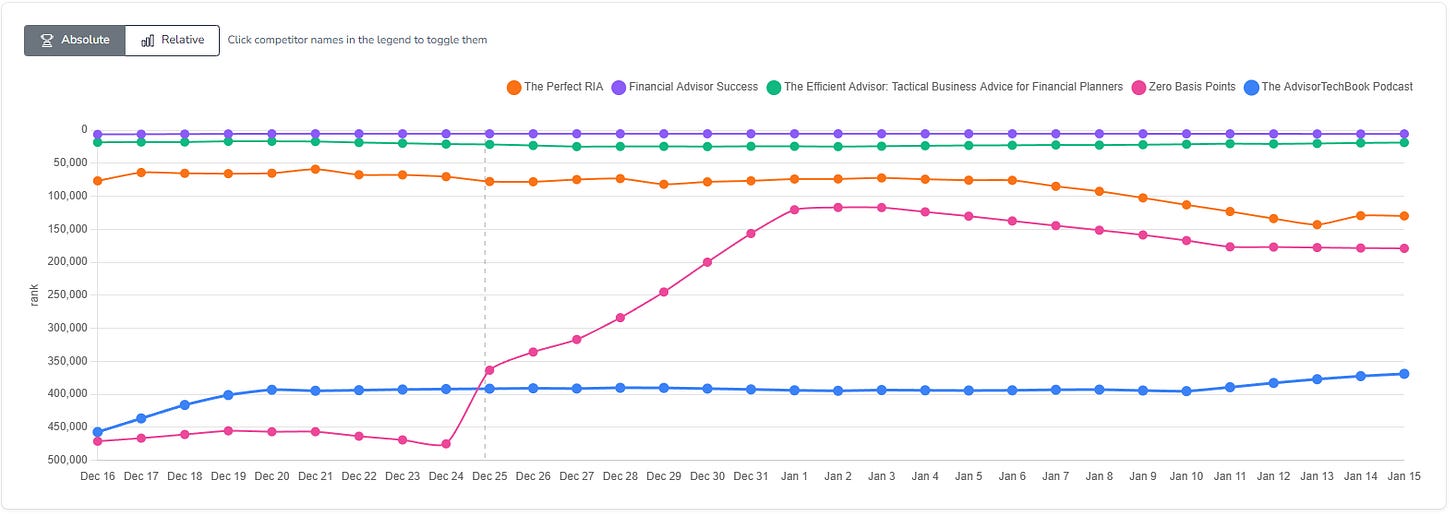

They’re currently beating me in the podcast rankings… but not for long :). I guess I’m a bit competitive.

Now for some spicy hot takes:

Financial Advisors, the services you provide to your clients are rapidly decreasing in value. AI is making them value-less. Your services will be worth 0 basis points.

Why do I say this?

Well, because very soon, a consumer will be able to fire up any AI platform and get investment advice, tax advice, estate planning advice, budgeting advice, etc… for free. Advice I might add that is often just as good if not better than the advice you’re giving them.

And they’ll be able to get it immediately. They won’t have to wait for days for you to respond to their email, or call them back, or text them from a compliance-approved number. (you need CurrentClient pronto)

They’ll get it immediately.

And this is bad news… but also good news.

You see, while the knowledge will be worth nothing… the relationship will be worth everything. All 100 basis points.

And you should not be charging a penny less than 100 basis points. If you are, you’re doing it wrong.

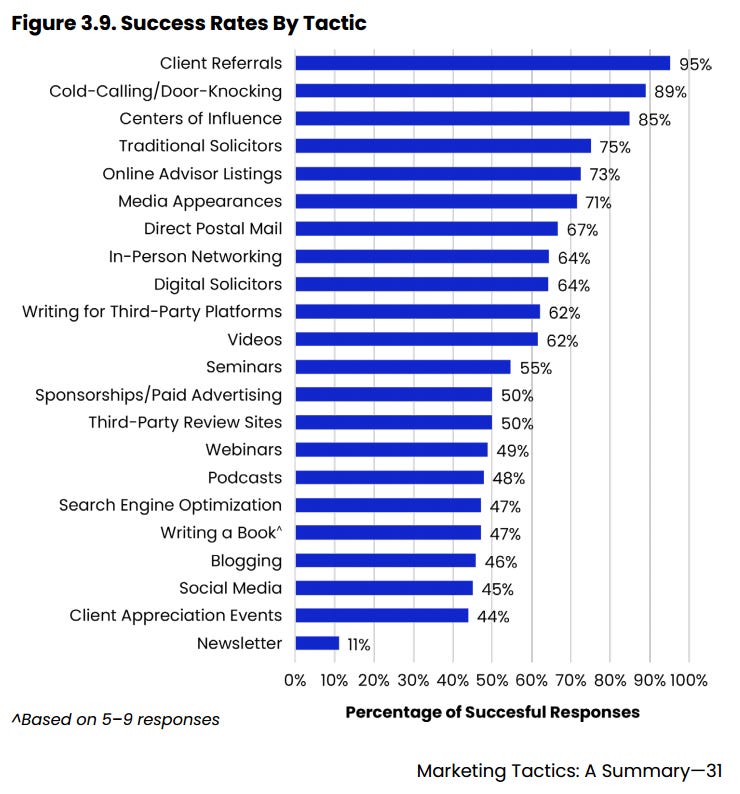

If I reference the Kitces marketing study again, the single best way to get new clients is from referrals from your CurrentClients.

The #1 way to increase client referrals?

Some of the comments on this post are excellent and said better than me, check them out here.

My point with all this is that “knowledge” is free now, “wisdom” is moving that direction, but “relationship” is at a premium, dare I say 200 basis points.

Build the very best relationship you can with your clients, charge a premium for it, and watch the referrals roll in.

Respond FAST, ideally immediately upon the 2nd ring

Solve problems better than they expect

Go beyond in helping them live their Epic Life

I think you get the point. I’m always open to feedback though. I’m wrong on all this stuff daily.

I take big risks in my ideas… sometimes they pay off…

Here’s a big idea:

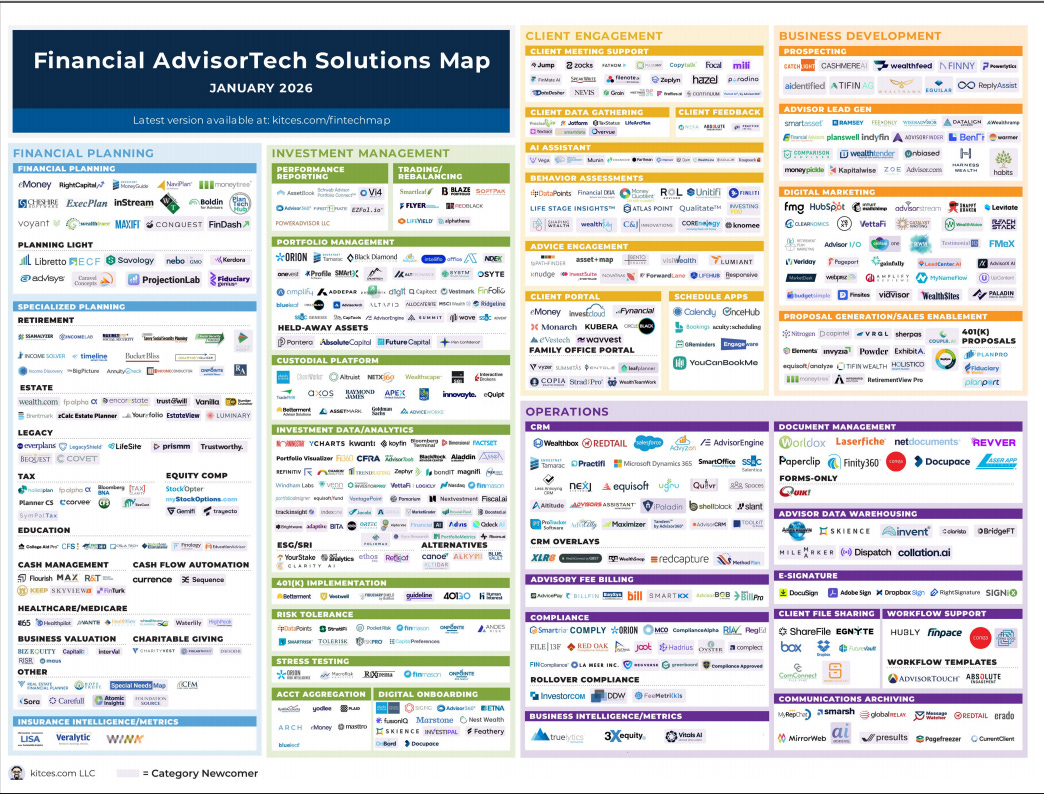

The Kitces AdvisorTech Map is about to go to war…

It may currently look like this:

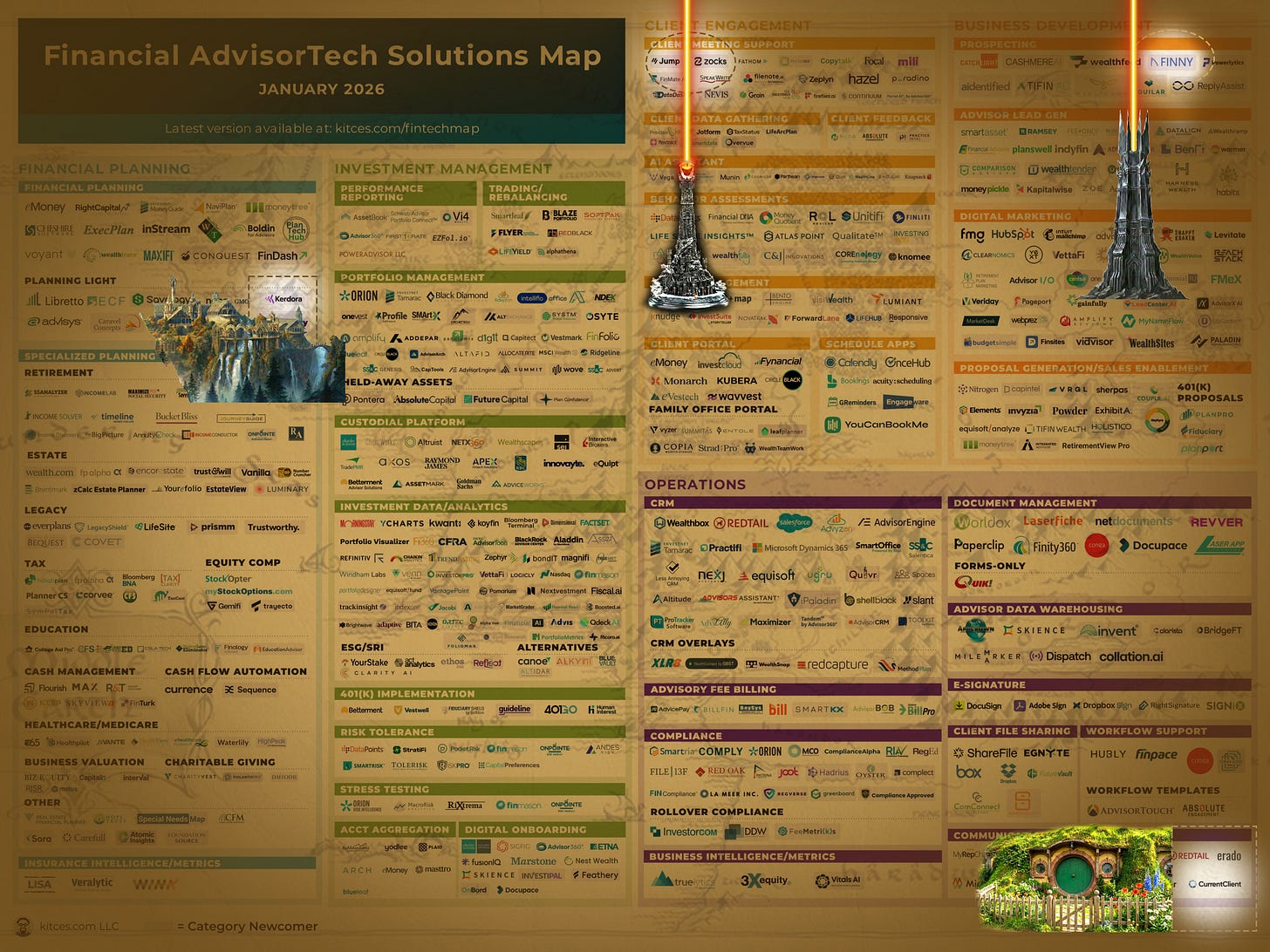

But I can see the future:

Bear with me as I explain this Lord of the Rings themed AdvisorTech map.

Shout-out to Syed Mustafa Hassan for helping me bring my idea for this map to life:

Double-bell this guy. He’s going places.

“I help financial advisors and firms gain trust, generate leads, and lose less HNW prospects with a branded institutional website just like their advice.

My service is productized so I have three packages.

The basic one for generating leads and converting more.

One with a custom clients portal included.

And the last with a client portal and a secure way to share documents directly through their website and connect website with CRMs so all leads directly go to CRM without manually input.”

AI is upon us. It’s a new thing. It’s a misunderstood thing. It’s a thing with a lot of power. Maybe a little bit like The One Ring:

One ring to rule them all,

one ring to find them,

One ring to bring them all

and in the darkness bind them.

Now I’m not suggesting AI is evil… at least not all of it. But some of it definitely is. I think of it a bit like Covid.

Do you remember Covid? A world pandemic. Lockdowns, masking, social distancing… weird times.

But a ton of good came from Covid. Freedom, big life changes, relationships restored, the Zoom Meeting. :)

Anyway, AI = The One Ring…

Two Towers have showed up on our beloved AdvisorTech map:

They are the first use cases of this new power that seem easy to apply, easy to raise money on, easy to take to market.

It’s been almost a full-time job trying to keep up with them. Dozens of inquires from the expert networks - Tegus, GLG, AlphaSights, etc.

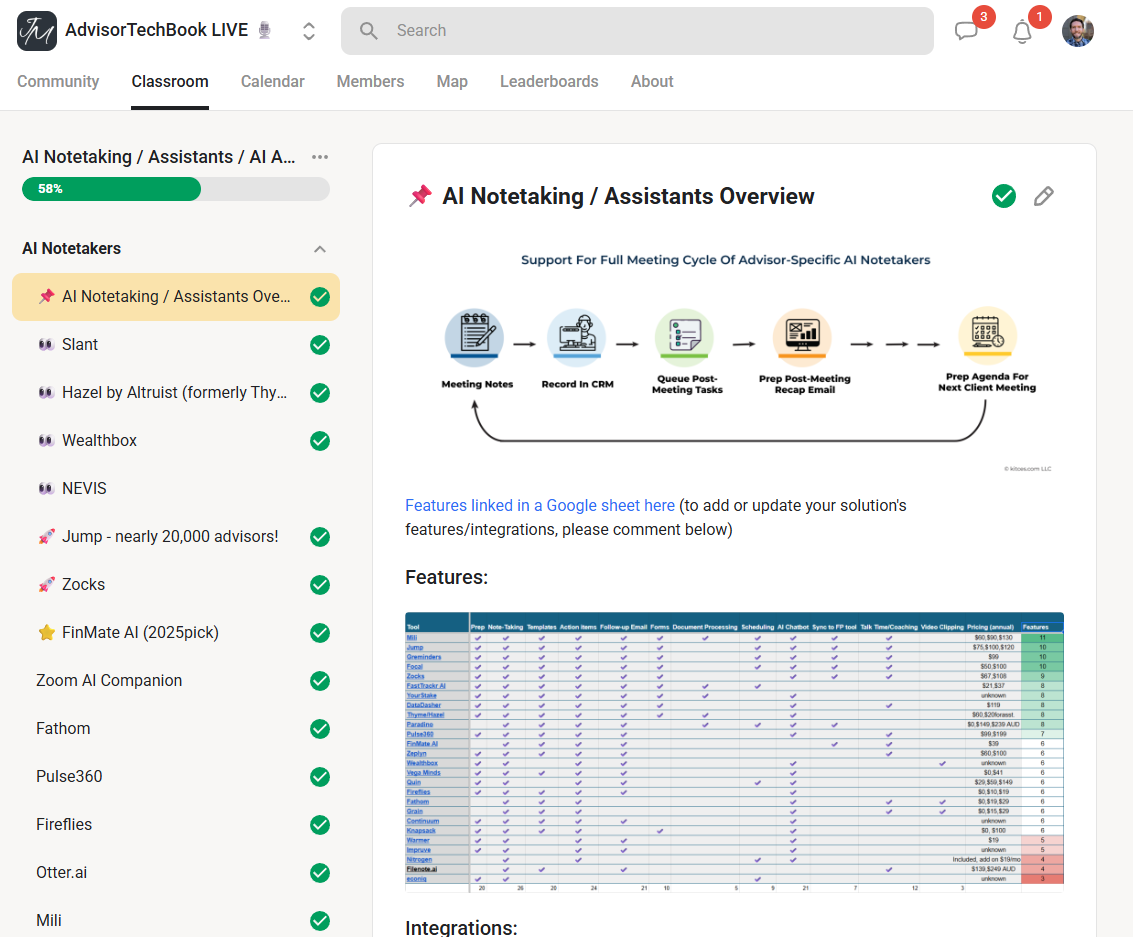

I made my own map of sorts:

Identified the features and the integrations across the board.

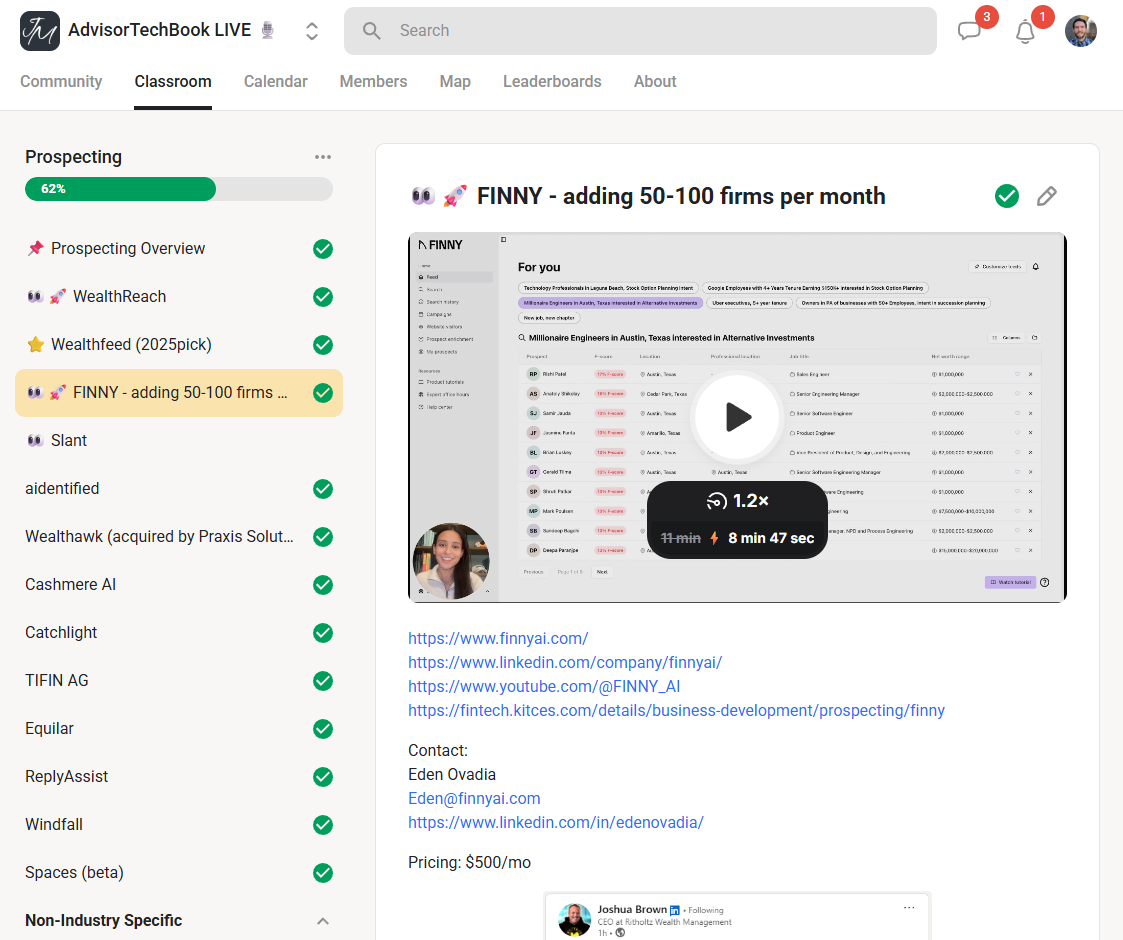

And then came the AI Prospectors:

The speed and adoption and all the big words… it’s been a little baffling.

I think advisors want to save time, I think advisors want better tech, I think capitalists see opportunity and want to make some money.

And there’s a map to conquer, people!

I would like to give a shout-out to Michael Kitces and his team for being the Map-Makers. Their work has been unparalleled in this industry.

So these two towers… let’s simplify and just call them Jump and Finny.

The AI Notetakers are Barad-dur. The AI Prospectors are Isengard.

A lot of money, a lot of power, a lot of change happening fast.

And they’ll be advancing on the map very soon.

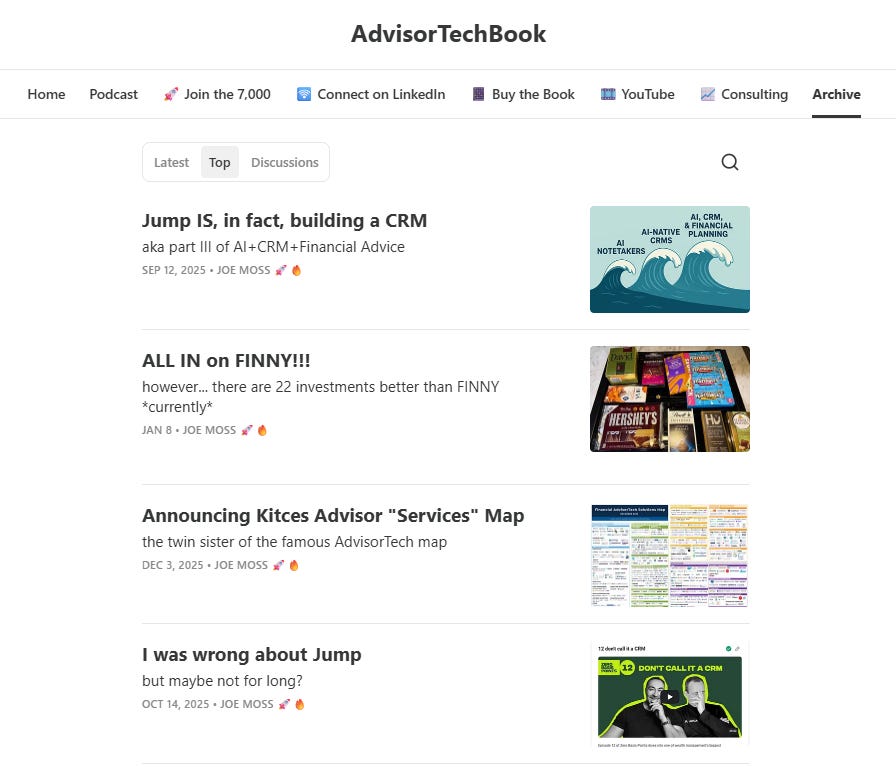

In case you thought they were just after Notetaking and Prospecting… well, we were all wrong. Maybe I was a little right:

These are my top Substacks ever. I thought Jump was building a CRM. The truth is Jump is building a lot more than a CRM. Jump wants the entire map.

FINNY wants the entire map.

Nevis wants the entire map.

Anybody raising tens of millions of dollars is going for a lot more than one itty-bitty category.

AND… some of them WILL succeed.

Now personally and from conversations with top experts, neither Jump nor Finny is actually the best product within their categories. There are better notetakers and better prospectors… but Jump and Finny are category kings and queens.

They have started the war.

To be continued…

To Epic Human Stories,

Joe

Great post, Joe.

And I always appreciate some Tolkien mixed in with Fintech 😉

Outside of new categories being defined and certain battle lines being re-drawn not much has changed with the Kitces Map. There have always been friends, enemies (competitors), and “frienemies” (partners that compete in certain areas).

AI solutions will become commoditized in the near future (2-3yrs) because advisors will simply expect them to exist as a standard feature. That should drive the price down overtime and force the standalone AI solutions to re-invent themselves as something more.

In the end however the “all-in-one” strategy won’t overtake the “best-in-breed” approach is my personal opinion. Advisors have historically chosen choice over a single vertically integrated tech stack. That’s not to say an “all-in-one” can’t coexist, it’s just won’t be the dominant model now or in the future.