Predicting the future of AdvisorTech

Unicorns: Part II

If you like words, and cry softly at night about what AI is doing to them, or to human creativity for that matter… stay tuned to the end for a little treat.

Now for the main course - this is Part II of “It’s so FLUFFY I’m gonna die!: What it takes to be an [advisortech] unicorn”

I mentioned companies like Holistiplan, Altruist, Calendly, Zoom… that have all become category kings and queens, risen rapidly in the process, and are solving simple problems excellently.

But I said I would predict “future unicorns” and this is what I shall attempt to do.

With as much grace and charm as the big banks predict capital market assumptions:

These two quotes seems appropriate about now.

“It’s tough to make predictions, especially about the future.”

~ Yoki Berra

and

“The best way to predict the future is to create it.”

~ Abraham Lincoln or Peter Drucker or both

So let’s create the future!

If you visit my book website, I have a bunch of solutions and categories you can filter for, one being “Future Unicorn”.

Let’s see what we got:

Each of these is solving a tough problem:

Compliance

Data Gathering

Estate Planning

Health Insurance Selection

Texting

Hmm, let’s see if I can rank them by how sure I am they will become a unicorn:

CurrentClient - positive, absolutely - even won the XYPN tech competition which Holistiplan already set a precedent for

Move Health - with the purchase of Caribou, they own this category

Greenboard - Compliance is definitely in need of a good, tech-y, AI-assisted solution

TaxStatus - it seems like an absolute no-brainer to me, but seems expensive enough that advisors are putting it off

Wealth.com - predicting it — but least sure — as there is lots of good Estate Planning competition

Ok, now beyond specific tech solutions, what are my predictions about “advisortech” in general?

I’m very bullish on people as advisortech. Human people, that is. While maybe not talked about quite like this…

Human Capital, Staffing, Recruiting, Hiring and Retaining top talent will be KEY to running a great AdvisorTech stack.

CSAs, CSSs, Paraplanners, Ops Managers, COOs, CTOs, even financial advisors themselves are the #1 integrations between the tech tools.

Integrations were a problem 10 years ago, they’re one of the main problems advisors mention about their tech stacks now, and they’ll probably still be a problem in 10 years.

People are the solution.

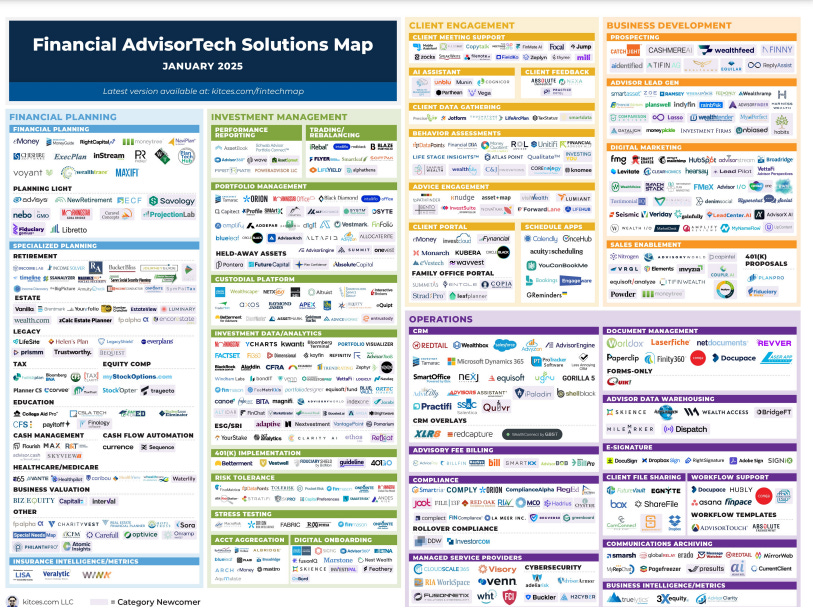

As far as the map goes…

I think it will keep growing - innovation, entrepreneurship, pain points to solve, even sub-sub-sub niches will lead to more and more point solutions.

At the same time, I think we’ll see more and more solutions fall off when they can’t reach viable ARR or don’t have a compelling offer… and also see lots of acquisitions and mergers as companies attempt to grab market share, retain their users, and seek the ever-coveted “All-in-One-that-people-actually-want-to-use” status.

Oh, there will still be plenty of “Worst-in-One’s”, but I think we’ll see more Advyzons too - A-grade solutions carefully built over years that just work… well!

For the AdvisorTech builders out there, Advyzon was founded in 2012 - that’s 13 years to build a top-of-the-line advisortech solution.

Altruist was founded in 2018…

So yes, great tech can be built, but it takes years, and years. You’re not going to start a AI+CRM and be Salesforce overnight.

Think longer-term I guess. Especially with all this AI buzz… although maybe I’m already old-school even as I say this.

Well, those are my predictions.

For the full story, pre-order a copy of my book:

Happy Tuesday!

Joe

The “treat”

Firstly, a couple definitions:

anglophone - an English-speaking person

pedant - a person who is excessively concerned with minor details and rules or with displaying academic learning