Jump IS, in fact, building a CRM

aka AI+CRM+financial advicing - Part III

An advisor recently asked me,

“Besides the meeting note takers, where do you see AI having the biggest impact in the industry over the next few years?”

Wouldn’t we all like to know?

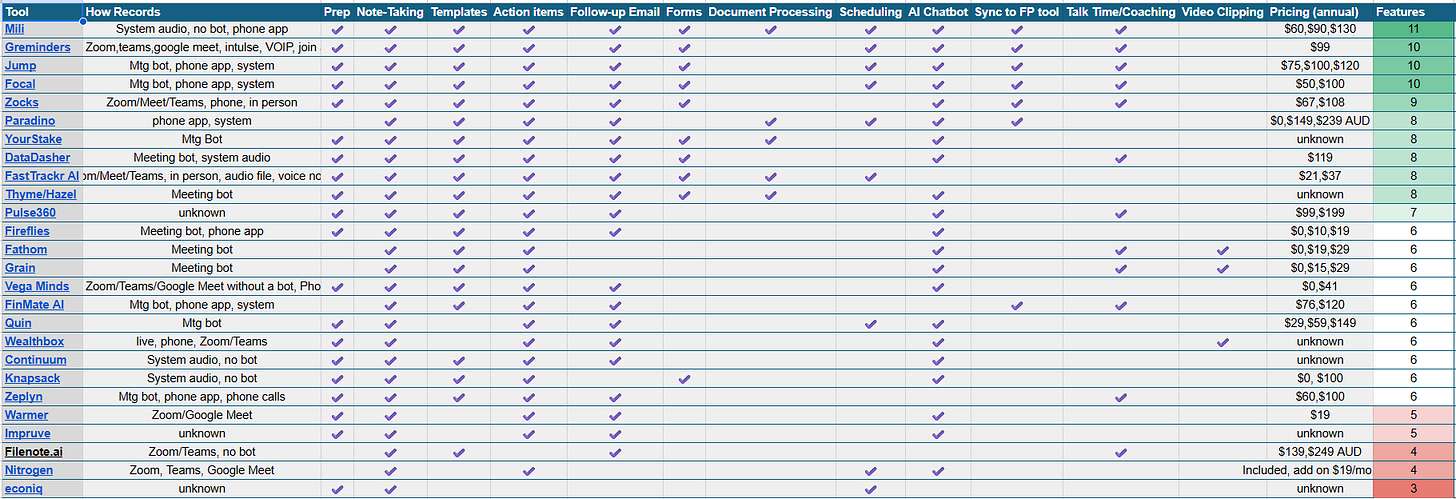

Recently, I attempted to capture all the ai notetakers for advisors along with their feature sets:

Since publishing this list of 26, at least 3 more have messaged me that I hadn’t heard of before.

There’s too many already, c’mon!

So I’m trying to figure out where this goes next.

I had been thinking basically two ways:

AI-native CRMs

AI centralized brain overlay

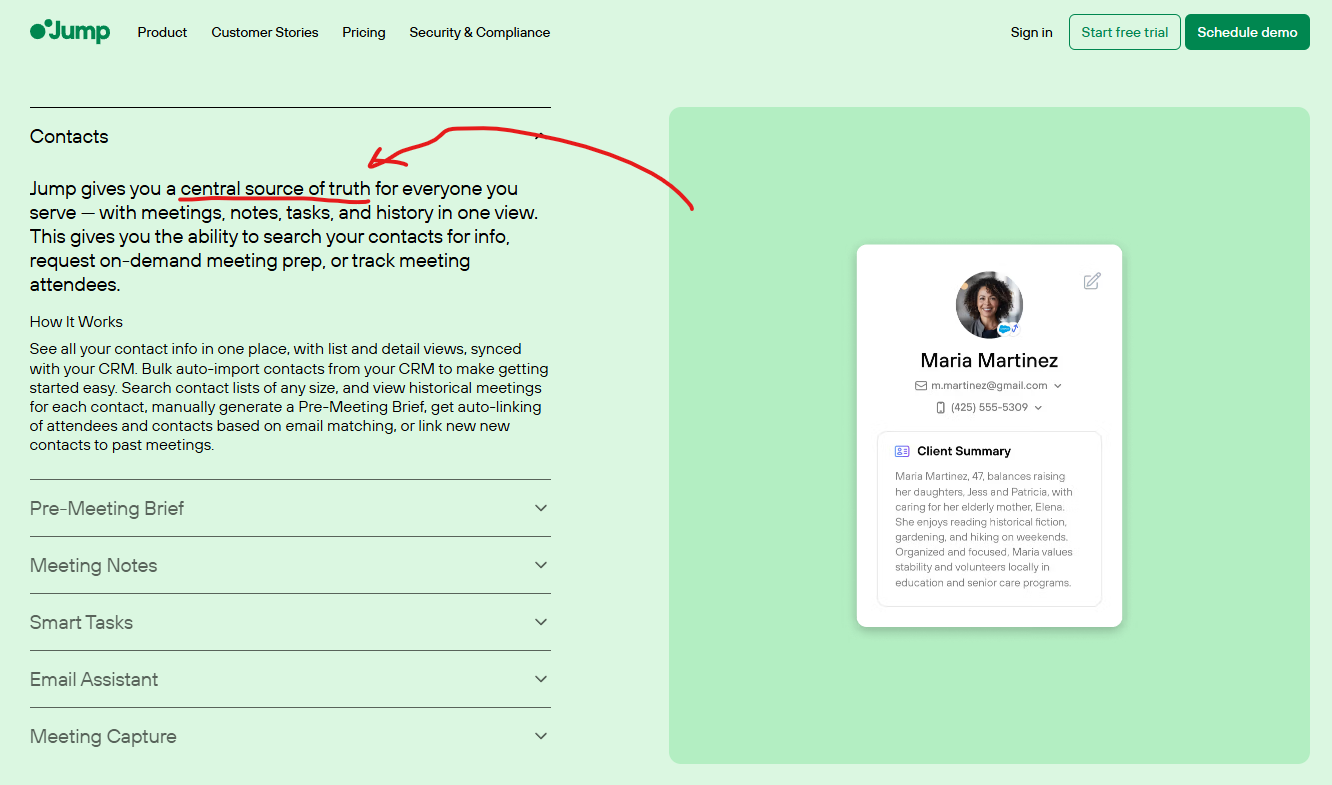

But then I saw Jump’s rebrand, and found this little gem:

Jump has a contacts database… but even more interesting, they’re calling it a “central source of truth.”

Ok, so its a CRM… albeit a light one, but maybe that’s a good thing?

Here’s the image I cooked up before seeing Jump’s new website:

You see, if I had to pick between some brand new AI-native CRMs and a CRM brain overlay, I’d choose the native one.

Everybody is complaining about the tech nonsense (uh, bloat) in this industry:

from the back of my book:

from Michael Batnick:

"On the tech side, there's an overabundance of choices and I think that there is an oversaturation."

from Shannon Rosic:

“I think in particular with AI, look, love all my note-takers and everything, but we have enough. No offense.”

from John Swystun:

The problem isn’t technology itself.

The problem is the way wealth management thinks about technology.

This industry is a decade behind the cutting edge - and even the cutting edge needs to be rethought.

CRMs haven’t meaningfully improved in years. Email and messaging tools are incredibly frustrating to use.

The default “solution” has been to cobble together 10–15 point tools, pipe the data into a lake, and attempt to stitch meaning together through BI overlays and novel interfaces.

Meanwhile, enterprises and advisors alike are stuck in the middle:

Managing archiving requirements and compliance.

Watching their Frankenstack get patchier and more painful.

Wondering why “innovation” feels like more work.

It’s no wonder wellbeing suffers.

There might be a better way.

It’s called an all-in-one. :)

I don’t just mean the whole best-in-class vs. all-in-one, but more like what John said, the whole thing needs a re-think.

There’s data that needs gathered - meetings, forms, documents, all comms…

There are meetings to be scheduled

There are financial plans to be created

There are prospects and clients to be tracked

Accounts to be opened

Billing to be done…

Dates and life events to be advised upon

Emails to be drafted

All things that AI is becoming very helpful with.

But maybe we don’t need to continue stitching all this together with 10-15 tools.

Maybe, just maybe, a few tools would work.

And that’s why I’m excited about Jump’s new CRM. It makes the path forward a bit clearer.

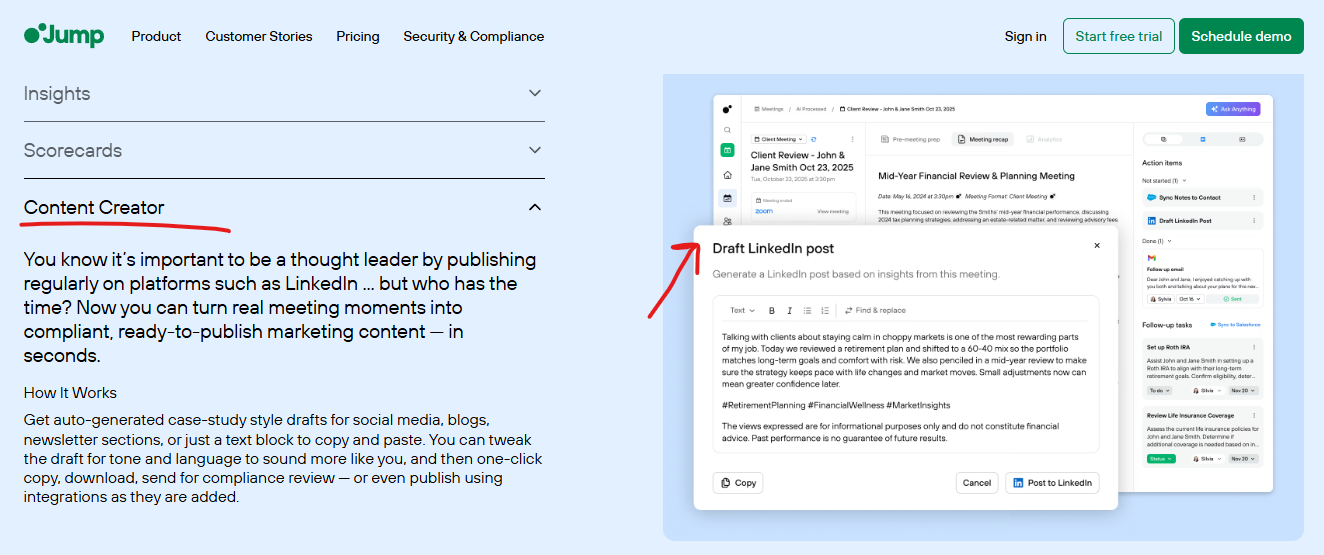

But there’s more… there’s coaching and LinkedIn content creation!

I might have gotten a lot more bullish on Jump this week. :)

Ok, so what’s the alternative? Brace yourself. It’s scary. 🩻

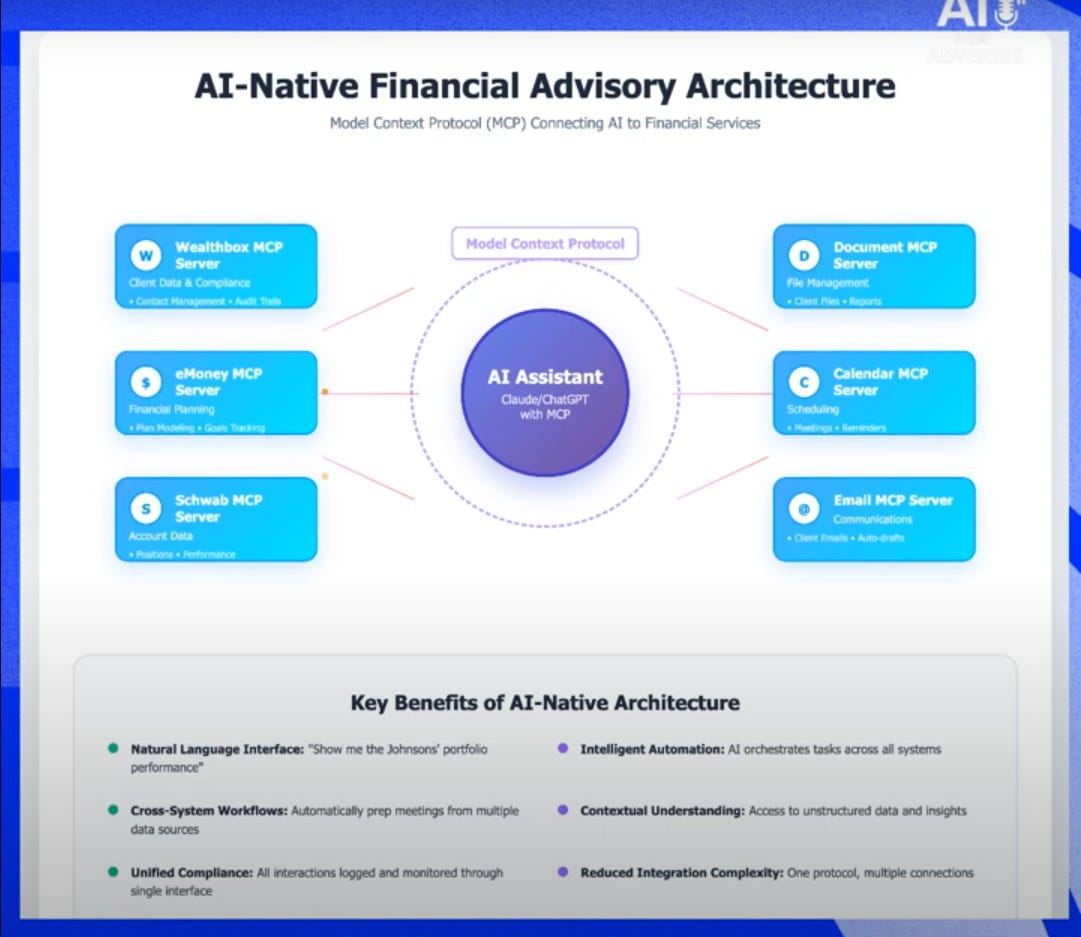

Image from James Cantwell in the AI for Advisors Podcast Ep. 2

Now, tbh, I don’t know what MCP is, and it’s probably pretty cool, but I don’t like the idea of yet another tool sitting on a bunch of other tools pushing data around. It hasn’t worked that well in the past.

As Batnick said of his Operations team: they "Make sure all the data is humming, because it doesn't hum. In fact, it does the opposite of hum, it vomits every week."

So that’s what I’m thinking going forward. We have AI notetakers that become CRMs, we have some new players built from the ground up, and we have the overlays. There’ll probably always be the overlays…

But that third wave, where it could get really cool… is that one solution that does AI, CRM, and financial planning in one.

Here’s who I’m watching:

Slant

AdvisorCRM

FinDash

Wavvest

Oh, and Hazel by Altruist… they’re bound to do something cool with that… possibly even a CRM ;)

And Wealthbox will probably do a pretty good job keeping up too. But they’re no longer the underdog, so…

If you’ve seen anything else cool in the AI+CRM+Financial Advice space, please let me know!

Happy Weekend,

Joe

Thanks for the podcast mention. Knapsack Studio ties together outreach, notetaking, and client communication. I think being the system of action may be more impactful than the system of record.

It’s also a cloud notetaker. May need to update your sheet. 🙃